After starting the day’s trading at 285.18 in the interbank market, the Pakistani rupee lost ground versus the US dollar during the intraday session.

The Pakistani rupee appreciated in the initial hours, with the interbank rate reaching a high of 283.87 and the initial hours, the Pakistani rupee valued, with the interbank rate reaching a high of 283.87 and then remaining there. While numerous currency counters still managed open market rates above 300 and as high as 310 despite the State Bank of Pakistan’s (SBP) new exchange regulations for commercial banks going into effect on Wednesday, they were still in the 290–295 area.

On Thursday, open market rates rose by nearly Rs. 27 to nearly Rs. 27 to a high of 290.25. The PKR lost 30 paisas today, weakening by 0.11 percent at today’s end to close at 285.68.

After an initial recovery, the exchange rate reached a peak of 283.87 at 11:30 AM. Today’s cash rate in Hundi is still more than 312; many believe it will continue to hover above this level.

As markets struggle with adjusting to the new interbank/open market settlement regulation, dollar buying has virtually stopped everywhere, and dealers are refraining from releasing USD cash flow.

On Friday, the cash rate in the black market was still averaging between 310 and 318.

One trader told that the interbank activity had decreased just days after SBP imposed the dollar pricing for international payments after SBP enforced the dollar pricing for making international payments, the interbank activity had decreased. Cash counters are no longer operating to reduce seller pressure, although deals have become challenging due to the high demand for foreign currency for Hajj costs.

Another trader stated that the regulator’s efforts to fix the currency rate would be limited by the new SBP regulations. In any case, the business community that deals in digital transactions is struggling to make ends meet as a result of delayed or halted currency payments.

Since January 2023, the currency has decreased by almost Rs 60 overall. It has lost value versus the dollar by more than 108 rupees since April 2022. According to the changes in exchange rates seen today, the PKR has dropped 30 paisas against the dollar.

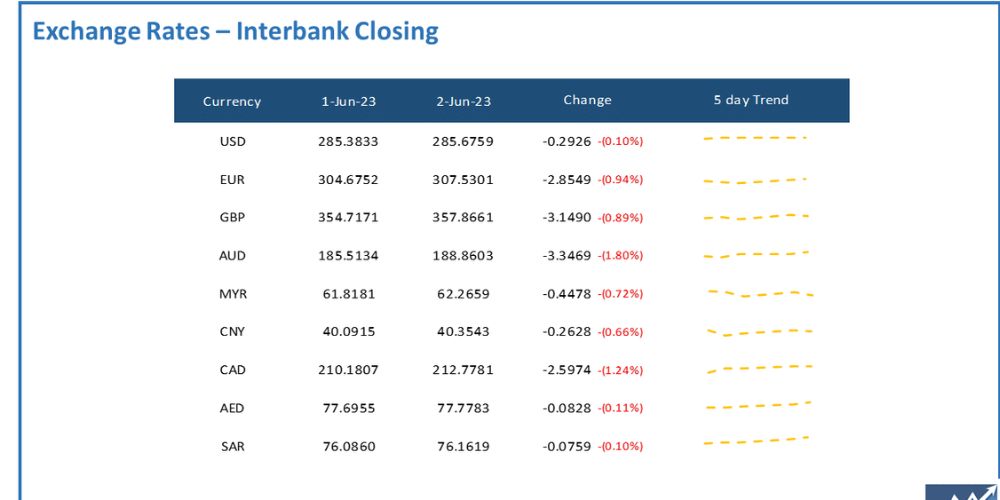

Today’s interbank market, the PKR was bearish relative to all other major currencies. It suffered losses of seven and eight rupees, against the Saudi Riyal (SAR) and UAE Dirham (AED).

In addition, in today’s interbank currency market, it lost Rs. 2.59 against the Canadian Dollar (CAD), Rs. 2.85 against the Euro (EUR), Rs. 3.14 against the Pound Sterling (GBP), and Rs. 3.34 against the Australian Dollar (AUD).